Enron Scandal Accounting Issues

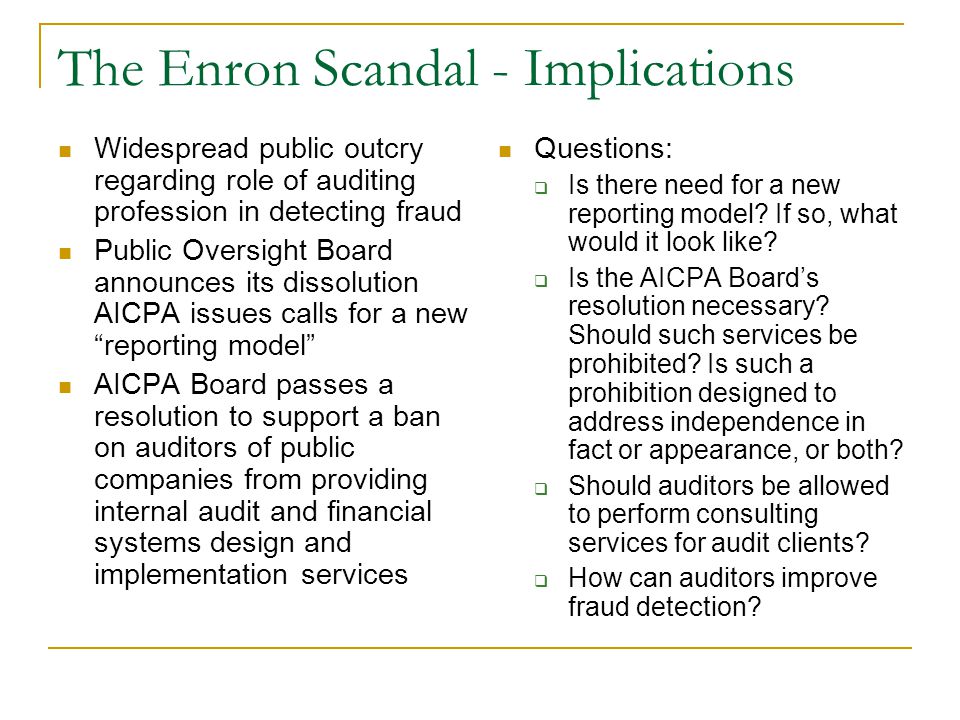

Arthur Andersens consulting had Enron as one of their biggest customers paying 52MM in 2000. To address problems like Enron.

The Enron Scandal Timeline Ppt Download

The role of mark-to-market and 3.

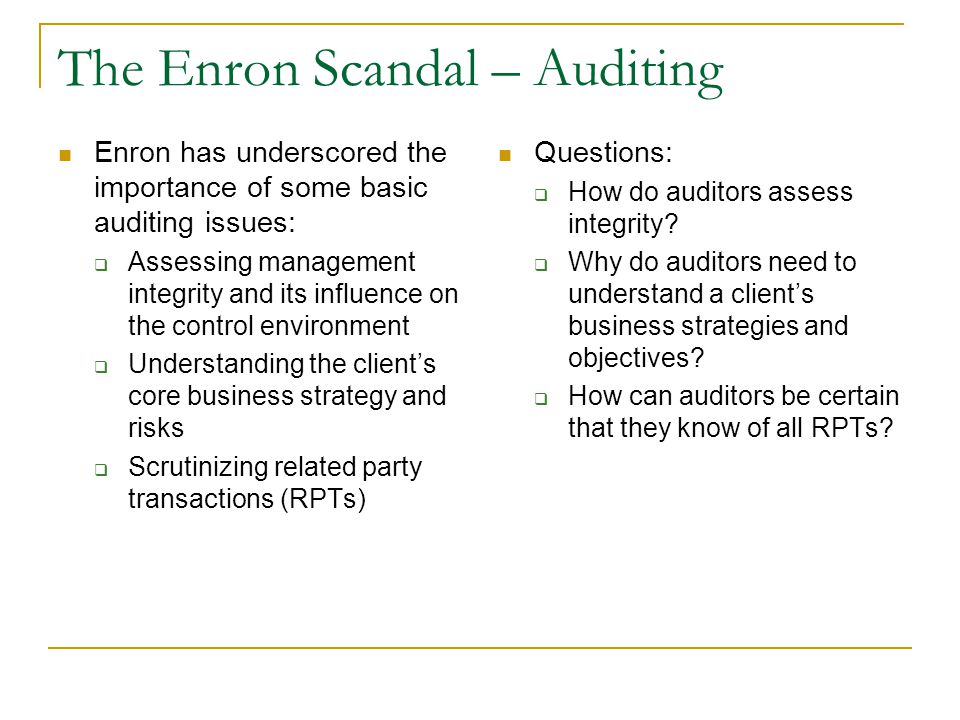

Enron scandal accounting issues. EVIDENCE OF A MISSED OPPORTUNITY TO DETECT AND HALT FRAUD AND BANKRUPTCY Charles C. The Enron scandal is likely the largest most complicated and most notorious accounting scandal of all time. Arthur Anderson abandoned its roles as independent auditor by turning a blind eye to improper accounting including the failure to consolidate failure of Enron to make 51million in proposed adjustments in 1997 and failure to adequately disclose. 8 2001 the company announced that it. The Enron scandal drew attention to accounting and corporate fraud as its shareholders lost 74 billion in the four years leading up to its bankruptcy and its employees lost billions in pension. Additionally Enron failed to consolidate the LJM and Raptor SPEs into their financial statements when subsequent information revealed they should have been consolidated.

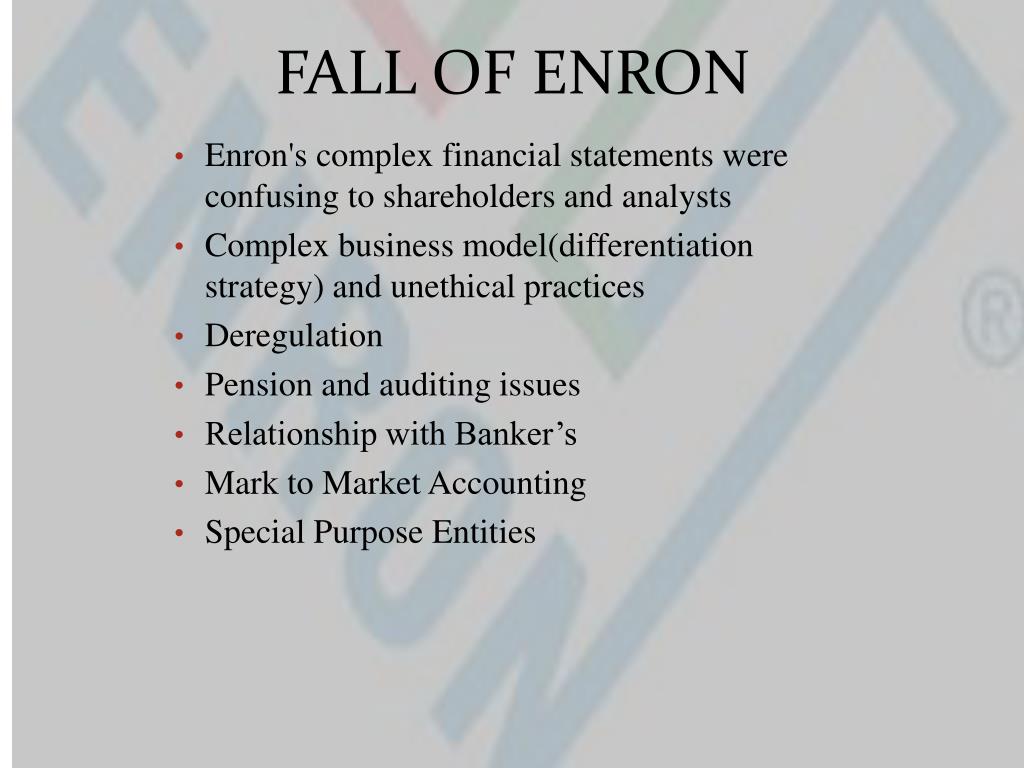

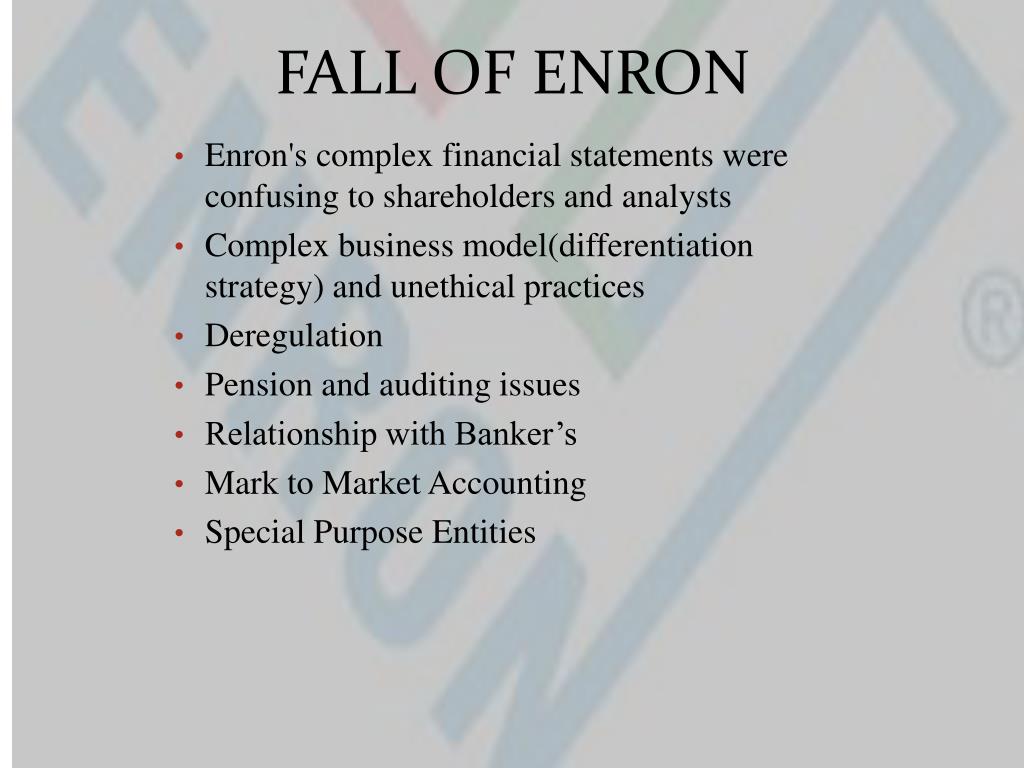

The manipulation of derivatives. In one of the most controversial accounting scandals in the past decade it was discovered in 2001 that the company had been using accounting loopholes to hide billions of dollars of bad debt while simultaneously inflating the companys earnings. Enrons downfall has been characterised as excessive interest by management in maintaining stock price or earnings trend through the use of unusually aggressive accounting practices healy 2003 as part of this enron used mark-to-market accounting for the energy trading business in the mid-1990s and used it on an unprecedented scale for. Enron executives and its accounting firm Arthur Andersen had warnings of problems nearly a year before Enron announced on October 16 2001 a 638 million loss for the third quarter of 2001. Energy commodities and services company Enron Corporation and the dissolution of Arthur Andersen LLP which had been one of the largest auditing and accounting companies in the world. Enron scandal at a glance Enron had grew from nowhere to becoming Americas seventh largest company in just 15 years employing 21000 staff in more than 40 countries.

Sendyona Adjunct Faculty Department of Accounting Finance School of Business Makerere University. Enron Corporation was a US energy commodities and services company based out of Houston Texas. They lied about their profits and were accused of a range of shady dealings including concealing debts so they didnt show up in the companys accounts. This paper aims to provide evidence of a missed opportunity to detect and halt. The creation of the off-balance sheet method OBSEs served its specific purpose in Enrons corporate accounting scandal. Enrons downfall has been characterised as excessive interest by management in maintaining stock price or earnings trend through the use of unusually aggressive accounting practices healy 2003 as part of this enron used mark-to-market accounting for the energy trading business in the mid-1990s and used it on an unprecedented scale for.

Its accounting scandal led to Enrons bankruptcy as well as the dissolution of Arthur Andersen one of the big five accounting firms. Accepted Accounting Principles GAAP that preceded the collapse of the Enron Corporation were. In a way that no previous accounting scandal has -- and there have been plenty of late -- the collapse of Enron and the role of its auditor. What is the Enron Scandal. Enron increased notes receivable and shareholders equity to reflect this transaction which appears to violate generally accepted accounting principles. Shareholders were wiped out and tens of thousands of employees left with worthless retirement accounts.

I am honored to be given this. The company utilized special purpose vehicles to hide its toxic assets and big amounts of debts from the investors and creditors. The off-balance sheet arrangements 2. The scandal surrounding Enrons demise engendered a global loss of confidence in corporate integrity that continues to plague markets today. Some main reasons behind this scandal are-Enrons leadership fooled regulators with fake holdings and off-the-books accounting practices. Questionable Accounting Leads to Collapse Once upon a time there was a gleaming office tower in Houston.

Scott 650 723-3070 The bankruptcy of the Enron Corp perhaps the largest corporate bankruptcy ever and the role and. Enron scandal series of events that resulted in the bankruptcy of the US. Enron used special purpose vehicles SPVs or special purposes entities SPEs to hide its mountains of debt and toxic assets from investors and. Through deceiving accounting tricks Enron Corporation the US-based energy commodities and services company was able to trick its investors into thinking that the firm was doing much better than it actually was. Relevant ethical issues 500 WORDS Expert Answer. Benston 404 727-7831 Kenneth E.

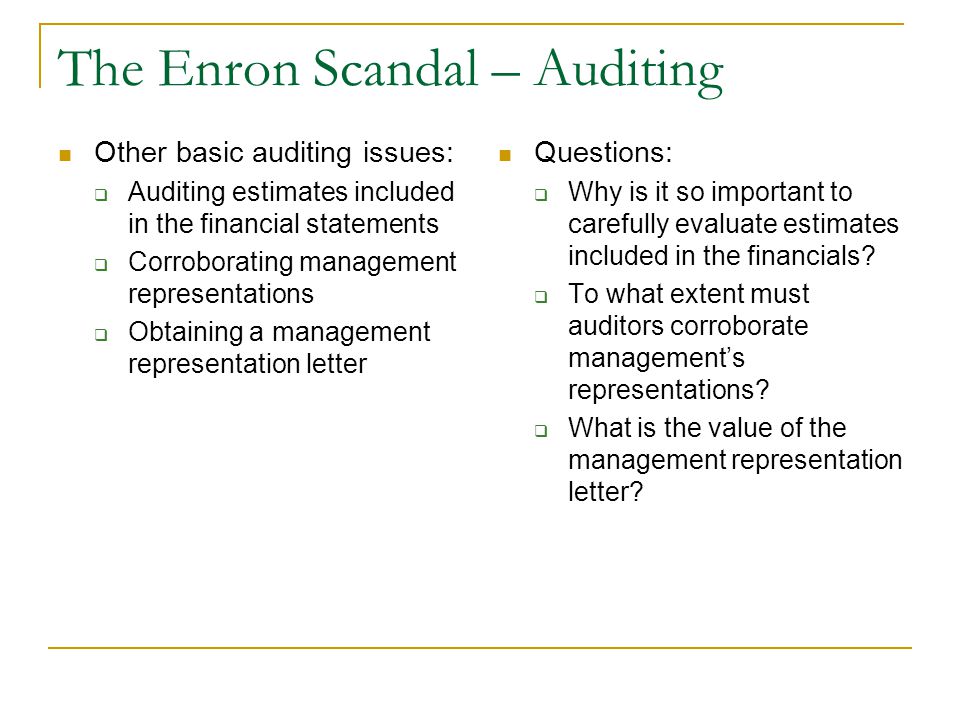

The Enron Scandal involves Enron duping the regulators by resorting to off-the-books accounting practices and incorporating fake holding. Enrons Accounting Issues What Can We Learn to Prevent Future Enrons Presented to the US House Committee on Energy and Commerce February 6 2002 Mr. Chairman and members of the Committee I want to thank you for inviting me to present my analysis of the accounting issues that led to Enrons downfall. The price of Enrons shares went from 9075 at its peak to 026 at bankruptcy.

Case Presentation Enron Scandal Slsi Lk

Enron Scandal The Fall Of A Wall Street Darling

The Enron Scandal Timeline Ppt Download

Enron Scandal Summary Causes Timeline Of Downfall

Enron Scandal The Fall Of A Wall Street Darling

Enron Scandal The Fall Of A Wall Street Darling

Case Study Enron Scandal Keywords Mark To Market Accounting Off Balance Items Derivatives Ceo Compensation Agency Problem Ppt Download

Enron Scandal By Matt Wong Thesis The Enron Scandal Influenced By Greed And Immoral Actions Led To The American Market Becoming More Strict Upon The Ppt Download

The Enron Scandal Timeline Ppt Download

The Enron Scandal By Kaitlyn Aya

Enron Scandal The Fall Of A Wall Street Darling

Impact Of The Enron Scandal On Accounting Standards Impact Of The Enron Scandal On Accounting Studocu

Enron Scandal One Of The Largest Bankruptcies In

The Enron Collapse An Overview Of Financial Issues Everycrsreport Com

Posting Komentar untuk "Enron Scandal Accounting Issues"